We’ve all heard the classic market maxim, “Sell in May and go away.” For many investors, that’s the introduction to market seasonality that suggests a six month period where it’s just best to avoid stocks altogether. Through my own experience, complemented with interviews with seasonality experts like ” We’ll dig…

The S&P 500 ($SPX) just staged one of the sharpest rebounds we’ve seen in years. After tumbling into deeply…

SPY and QQQ crossed above their 200-day SMAs with big moves on Monday, and held above these long-term moving…

For those of you who are a bit more steeped in technical analysis, you’ve likely heard of Dow Theory.…

The S&P 500 ($SPX) just staged one of the sharpest rebounds we’ve seen in years. After tumbling into deeply…

Looking for breakout stocks and top market leaders? Follow along Mary Ellen shares stock breakouts, analyst upgrades, and sector…

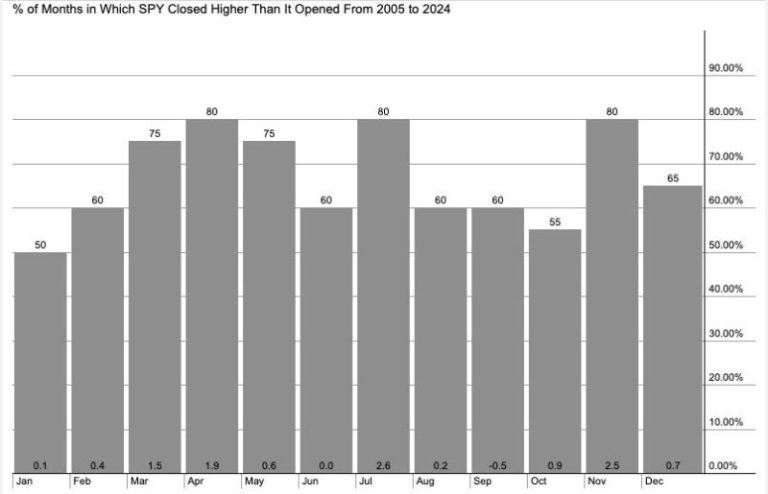

We’ve all heard the classic market maxim, “Sell in May and go away.” For many investors, that’s the introduction…

In this in-depth walkthrough, Grayson introduces the brand-new Market Summary Dashboard, an all-in-one resource designed to help you analyze…